-

The art of letter writing is fast dying out...1871

-

Claims of supernatural powers

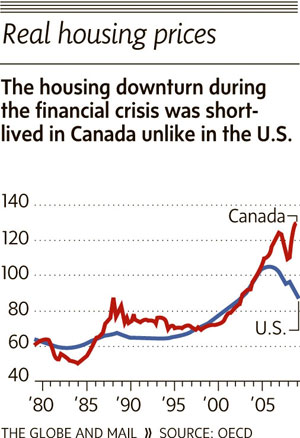

The long-coming and oft-denied Canadian real estate meltdown just got one step closer to reality, with a stern---but still too little, too late---warning from the chief economist of TD bank.

We need to acknowledge that a significant imbalance has developed and it poses a clear and present danger to Canadas medium-term economic outlook. It also suggests that further actions to constrain lending growth may be prudent, he said. If the overvaluation was fully unwound rapidly, it would be three times the correction in the early 1990s.

Meanwhile 418 units in a Vancouver pre-sale sold out in a breathless four hour scramble.

Seth Godin's recent work is the poster-child of a kind of 'new apocalypticism', an idea which has blossomed since the economic meltdown of 2008. Classic apocalypticism is a specific kind of belief for oppressed communities: that everything will come right in the end for the believing community after all that's wrong with the world is swept away.

This 'new apocalypticism' does something similar for people who's lives have been rocked by the breakdown of the 'capitalism compact'---which contained amongst other things the belief that a rising tide raises all boats. This idea has been blown apart by the financial crisis and ensuing economic fallout, and those most affected are looking for something new to believe. Something which will make the injustices of recent economic history right.

This loss of belief in the old ideas (the economic metanarrative if you like) is the most telling change of the last few years. People feel betrayed that the dramatic economic expansion since 9-11 was actually an illusion caused by a debt bubble--and doubly so because a few 21st century 'robber barons' are the only ones to benefit.

The message of the 'new apocalypticism' is that the old way was wrong. It's how you feel that matters, not the actuality of your situation which is in all probability rather depressing. A great army of authors, social theorists, coaches and motivational speakers has adopted this idea and most of Seth's recent work (post 2008) focuses on it from several different angles. Variously, according to Seth, we all need to become; leaders, corporate innovators, irreplaceable artists and marketing storytellers. His most basic notion is the idea that 'how people feel about a product or service is three times more important than the actual product or service.' Given that the middle class has experienced a decline in living standard since the 1990's and that people are working harder and longer (those with jobs at least) than any time since the pre-war era they are looking for something to make themselves feel better and Seth is making a successful business out of doing exactly what he preaches: making his customers feel better.

Not sure how i missed this when it came out five years ago.

Former management consultant Matthew Stewart's witty and damning article on the state of Management Consulting and business school education reads like a synthesis of the ideas of Pfeffer, Mintzberg, and Bennis et al, but is actually the result of his own experience as partner in a management consulting business.

With a PhD in Philosophy from Oxford rather than the habitual Harvard MBA, his writing is a refreshing change from most business journalism.

As reported in the fall, Millenium water, the second name for the briefly proud Olympic Village of the 2010 Winter Olympics, went bankrupt after 6 months of trying to sell itself as an overpriced luxury condo village.

This month, the former Olympic Village has been renamed yet again to the ridiculously parochial "The Village on False Creek" and will try once more to lure unwary buyers. Funny how marketers are convinced that all that's required to smooth away a debacle is a new name and brand statement.

They might want to try something else.

John Perry Barlow recently tweeted a list of values he had written down when he turned 30. Miguel de Icaza collected and organized them.

They're all good: one that resonates right now...

Avoid the pursuit of happiness. Seek to define your mission and pursue that.

assuming you can believe an economic projection 40 (count em) years into the future....

HSBC admits that its economic projections are based on a "rather rosy scenario". Yet one thing seems clear. As superpowers of world food output, the US and Canada are sitting pretty

Great post from Paul Graham, from Summer 2010, about the reasons for Yahoo's inexorable decline.

"In the software business, you can't afford not to have a hacker-centric culture."

Goldman and the Russian Investment Fund Digital Sky Technologies put $500 million in for 1% of FB.

Like the expected death of a sick and elderly relative, the demise of Millenium Water in Vancouver---expected for months by many housing realists---is still a shock. Perhaps we secretly hoped that the laughable boosterism of the Vancouver Real Estate industry was somehow going to pull it through. RIP

Bloomberg:

A majority of global investors predict Ireland will default on its sovereign debt, showing that weeks of efforts by the government of the onetime Celtic Tiger havent allayed concerns about its creditworthiness.

and from the Sunday Times

FEARS are mounting that Ireland could default on its soaring national debt pile, amid continuing worries about its troubled banking sector.

Maps and Wave inventor Rasmussen talks about why he's decamping to Facebook. Not surprisingly, the ramp up of Google to a whopping 25,000 people is part of the problem. Although, Facebook, already at a headcount of 2000, can hardly be considered a startup.

Steve is one of the best product guys in high tech, perhaps THE best ever, but he's no engineer. Combine that with a propensity to hyperbole and the result is periodic outbursts of ill-judged, misconstrued and reputationally-damaging silliness...

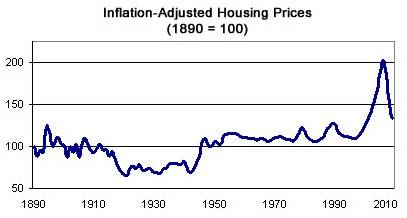

For the last 100 years houses have primarily provided shelter and a hedge against inflation. It's only recently that they've become a widely used source of speculation and --- via home equity loans --- collateral for collosal household debt.

"Work is about a search for daily meaning as well as daily bread, for recognition as well as cash, for astonishment rather than torpor; in short, for a sort of life rather than a Monday through Friday sort of dying."

Studs Terkel

Talk about closing the door after the horse has bolted...

The Paris-based OECD, a club of wealthy nations that includes Canada and 32 other economies, suggested Ottawa could require home buyers to put up bigger down payments if they want their mortgages federally insured. The government could also consider forcing banks to disclose the sensitivity of their mortgage revenues to rate hikes.

Finally, media stories are starting to confess what the data has been showing for more than two years. The Vancouver bubble is bursting. In fact the recent stimulus-induced bounce (a temporary reverse in the decline that was just getting started) has boosted the peak even higher, which makes looking over the precipice even more vertigo-inducing than it was two years ago.

Nice to see the usually smug Bob Rennie looking seasick for a change...

From Paul Grahama's "Hackers and Painters" comes a wonderfully insightful essay about contribution and reward. In describing a startup as a place where individuals can be rewarded for their contribution, he identifies the biggest impediment to smart and/or ambitious people in bigger companies: that their contribution is averaged out with all the other dumb or unambitious folks.

According to Graham: to get rich you need to get yourself in a situation with two things, measurement and leverage.

Clay Shirky on people power and "cognitive surplus"